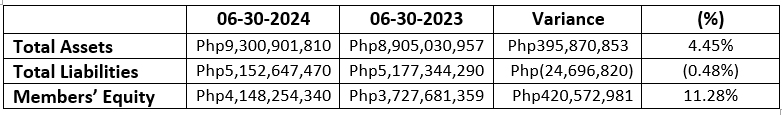

The highlights of the financial performance of PPSTA as of June 30, 2024 with comparative figures for the same cut-off in 2023 are summarized as follows:

1.Total Assets – Total Assets reached Php9.301 B, up by Php395.871 M or 4.45% compared to the Php8.905 B registered as of June 30, 2023. Total assets is consist of current and non-current assets. Current assets are cash and cash equivalents, loan receivables, claims/premium receivables, advances/other receivables and prepayments/other current assets while non-current assets is composed of guaranty fund, held to maturity investments, available -for-sale securities, investment property, property/equipment and intangibles. The increase in the current assets as of the cut-off is primarily attributed to cash/cash equivalents and loans receivables under current assets.

2.Total Liabilities – Total Liabilities amounted to Php5.153 B lower by Php24.702 M or 0.48% than the Php5.177 B figure as of June 30, 2023.

3.Members’ Equity – Members’ Equity was recorded at Php4.148 B, a substantial increase in the amount of Php420.573 M or 11.28% compared with the Php3.728 B registered as of June 30, 2023. Members’ equity continues to grow over the years showing our effective asset management and ability to meet short or long-term liabilities promptly.

4. Total Revenues – Total Revenues as of cut-off amounted to Php461.203 M lower by Php113.421 M or 19.74% than the total revenues of Php574.625 M posted as of the same cut-off last year. The decrease in revenues is primarily attributed to the control mechanisms we have implemented in loan operations for BARMM.

5. Total Expenses – Total Expenses amounted to Php286.048 M lower by Php16.170 M or 5.35% compared with the figure as of the same cut off period for 2023.

6. Income Before Legal Reserves – As expected in light of our reduced revenues, our income before legal reserves stood at Php175.155 M lower by Php97.252 M or 35.70% than the amount of Php272.407 M registered as of the same cut-off last year.

7. Collections – In light of the instructions of the Board to present comparative figures for collections: latest month with posting and immediately preceding month, below are the figures for the months of August and September, 2024:

AUGUST SEPTEMBER INC./DEC.

Over-the-Counter Payment Php 166,760,446.20 171,309,478.96 4.549 M

Loan Renewals 174,067,672.18 107,042,695.60 (67.025 M)

MAS/Retirement Claims 4,630,430.68 5,189,785.28 559K

Due to the conditional resumption of the P500,000.00 maximum loanable amount for BARMM and Region 9, we experienced an increase of 129.41% in collection from loan renewals for the month of July in the amount of Php189.867 M as compared to the amount of Php82.762 M registered as of the end of June 2024. As most renewals happened in July, collection from loan renewals decreased by Php15 M in August and Php67.025 M in September. However, we project an average of not less than Php100 M for loan renewal collection if we will remove the conditions set forth in the resumption of Php500,000.00 loan to BARMM and Region 9. Please note that as of now, we can only grant Php500,000.00 to member-borrowers from these regions if they have been granted the same amount prior to the suspension on November 15, 2023.

At present, completed collections from the RPSUs are for the month of August, 2024. Total collections of this kind for the month of July amounted to Php163.311 M which amount increased to Php163.330 M last August. Collections from PPSTA employees was in the amount of Php1.056 M in July and Php1.070 M in August.

LOAN, CLAIM AND MEMBERSHIP OPERATIONS (as of September 2024)

- Total Loans Granted – Total loans granted as of September 30, 2024 was in the amount of Php1.354 B for 6,466 member-borrowers which amount is only 54.14% of the Php2.5 B target for 2024. Last year, we were able to release a total amount of Php3.719 B for 15,029 member-borrowers as of September 30, 2023. (Annex D)

- Total Benefit Payments – Total processed claim applications is 7,138 in the amount of Php309.456 M, brokendown as follows:

- AMOUNT

MAS Death Claims (w/ Reinsurance) 7 P 900,000.00

MAS, NMAS, MAS 65 Death Claims 744 82,254,854.53

(w/o Reinsurance)

Termination of MAS Membership/ 2,728 61,294,785.70

Lapsed MAS Policies

MAS-Early Redemption for Exempted 966 85,856,850.69

Members

MAS 65 Endowment Benefit 79 3,950,000.00

GLPP Microinsurance 3 69,707.00

NMRBS Death Claims (w/ Reinsurance) 2 121,102.11

NMRBS Death Claims (w/o Reinsurance) 25 2,055,516.76

NMRBS Termination, Maturity, 932 34,191,602.16

Retirement, ERP, Lapsed Policies

Old MRBS Claims 369 3,702,235.97

MRBS Plus Claims 1,283 35,059,342.21

(see: Annex E)

- Membership Applications Created in the System (Annex F)

Profiles of membership applicants are created in the system upon:

BARMM – Receipt of application

Other Regions* – Upon approval by DepEd Verifier

*Except Region 5. If the membership application from the region is received via a roving activity, membership profile is created in the system upon receipt of the application.

As of September 30, 2024, the Management has created a total of 1,603 membership profiles in the system for NMAS with BARMM getting the largest bulk thereof at 361 followed by Region 8 at 201, Region 12 at 195, Region 2 at 150 and Region 4A at 119. At the bottom five (5) are the following regions: Region 10 – 1, Region 9 – 5, Region 11 – 13, CAR – 17, and CARAGA – 24. Last year, we had a total of 7,321 enlistments for the plan.

I wish to emphasize that we still lag in membership generation. Per the Actuary, the ideal ratio is 1:4, meaning, for every 1 membership attrition, there should be 4 new members.

Moreover, our target for this year is to generate at least 20,000 new members for NMAS. With only five (3) months left, we have to generate 18,397 new NMAS members having generated 1,603 only from January-September, 2024.

For MRBS+, created membership profiles totaled 1,216.

Per regulation, membership count is on the basis of active members under the basic plan which is NMAS. Further, created membership profile in the system will only be included in the count if the deduction for the premium payment for the plan has been effected from the applicants’ respective salaries.

With regard GLPP, our total enlistments from January-September 2024 is 4,419.

Released Honoraria (January – September 2024)

The Management processed and released the aggregate amount of Php5.216 M for Solicitors’ Honorarium, Local Chapters’ Honorarium and Regional Chapters’ Honorarium. Solicitors’ honorarium are released automatically while chapters’ honorarium are released upon request.

| REGION | SOLICITORS’ HONORARIUM | LOCAL CHAPTERS’ HONORARIUM | REGIONAL CHAPTERS’ HONORARIUM |

| 1 | 3,100.00 | 362,577.63 | 56,526.38 |

| 2 | 18,900.00 | 268,522.97 | 104,051.15 |

| 3 | 27,550.00 | 69,050.37 | 90,944.04 |

| 4A | 5,600.00 | 340,895.32 | 97,571.25 |

| 4B | 2,750.00 | 86,431.76 | 36,764.62 |

| 5 | 133,800.00 | 900,625.00 | 187,646.06 |

| 6 | 0 | 0 | 0 |

| 7 | 8,950.00 | 10,766.17 | 0 |

| 8 | 9,050.00 | 116,467.85 | 34,981.86 |

| 9 | 12,600.00 | 98,533.50 | 31,684.41 |

| 10 | 28,500.00 | 18,272.90 | 0 |

| 11 | 0 | 56,032.44 | 0 |

| 12 | 5,300.00 | 63,394.96 | 18,873.95 |

| CRG | 1,850.00 | 88,699.94 | 27,099.64 |

| BARMM | 54,800.00 | 1,089,686.73 | 491,875.98 |

| CAR | 0 | 0 | 24,441.24 |

| NCR | 1,900.00 | 18,973.81 | 109,908.99 |

| TOTAL | 314,650.00 | 3,588,931.35 | 1,312,369.57 |

BUDGET VERSUS EXPENSE (as of June 2024):

Our projected revenues as of June 2024 is Php623.192 M but as of end of June 2024, our generated revenues amount to Php462.657 M. Total projected benefit payment as of cut-off is Php263.053 M while actual benefit payment amounted to Php245.986 M. Budget as of June for operating expenses is Php119.549 M while actual expense as of cut-off is only Php67.498 M. Budget for capital expenditures is Php53.177 M while actual expense is P4.664 M.

Budget for major repairs and renovations are under capital expenditures. We have budgets for them but since we have not yet implemented any major repair or renovation as of now, the budget allocations remain untouched.

| PARTICULARS | BUDGET for 1/24-6/24 | UTILIZATION ao 6/2024 |

| Revenues | 623,192,276 | 462,656,921 |

| Benefit Payments | 263,053,286 | 245,985,692 |

| Operating Expenses | 119,548,596 | 67,498,431 |

| Capital Expenditures | 53,177,313 | 4,663,933 |

Annex I – Breakdown of Budget and Expenses

SUMMARY OF MANAGEMENT UPDATES/ACTIONS/CONCERNS:

- Laoag Property – The Sangguniang Panlungsod of the City Government of Laoag has approved the purchase and payment of the 10-hectare portion of the Laoag Property which they offered to buy and which we have accepted. It must be noted that their offer to buy the property was at the rate of P150.00 per square meter but we insisted that all cost of the sale shall be borne by them. The full purchase price shall be paid in cash. We have already sent them a draft of the Deed of Sale and we now await for the copy thereof from their end. Inasmuch as the signatory to the contract is the President, may we ask that the Board passes a resolution formally authorizing the President to sign the Deed of Sale with the City Government of Laoag. Our target is to have the signing within the month of November. Please note however, that per advice of the City Government, the processing of the payment shall be made after the signing as they will need a copy of the signed and notarized instrument.

On the offer to buy by St. John of Jerusalem, we asked them to submit valid corporate documents including a decision from the Securities and Exchange Commission (SEC) setting aside the revocation of their registration. As reported to the Ad-Hoc Committee on Laoag Property, the SEC registration of the foundation was revoked on 03 February 2003. In fact, SEC issued a warning on 30 June 2020 that any matter entered into with the corporation that is not for the purpose of liquidation is a void transaction because it is no longer in existence. It likewise advised the public not to join in any scheme offered by the foundation. In addition, it is worth mentioning that nothing in the documents which they have submitted show their financial capacity to pay our property in the event that we decide to pursue the sale. I wish to emphasize that in a contract of sale, a legal source of fund on the part of the buyer must be established in order to ensure a legally binding transaction.

Relative to VSARO, we have already submitted to Mr. Boni Miguel copies of all the documents that they need and he had sent us a draft of the formal offer to purchase so we can validate the listed lot areas. If we wish however to pursue the sale to VSARO, I wish to suggest that we deduct 10 hectares from the available area under the title where the 10-hectare portion of the City Government of Laoag shall be taken as we can sell the same for a price bigger than the amount offered by VSARO which is a Php900.00, gross, per square meter. They intend to pay the property on a cash basis. Expenses for the sale shall be borne by both PPSTA and VSARO, to wit: PPSTA – Capital Gains Tax, Professional Fee, Real Estate Tax and other assessment expenses; VSARO – Documentary Stamp Tax, Transfer Tax, Registration Fees and other expenses related in the issuance of a new land title to the new owner. Net proceeds for PPSTA will be Php700.00 per square meter.

- System Migration Project by Ubivelox – We have received a copy of the letter from Ubivelox requesting for another extension of nine (9) months but the letter did not indicate the conditions set by the Board during the meeting last September 4. Nonetheless, they continue to work on the project as reported by our Technical Team.

- Onsite Annual Physical Check-Up of Trustees and Employees – To ensure the physical health and wellness of the trustees and employees, the onsite annual physical check-up as provided by iCare, our healthcare provider, is scheduled tomorrow, October 18, from 8:00 AM – 4:00 PM at the PPSTA Auditorium. The check-up covers the following: physical examination, complete blood count, urinalysis, fecalysis, chest x-ray, electrocardiogram, and pap smear for ladies 35 years old and above.

- Management of Official Web and FB Pages – Mr. Francis Allan Maniego, IT Head, has been designated as Administrator of our Social Media Accounts and Website. This will afford a closer monitoring and updating of our online platforms and, at the same time, maintain our closer touch with the teachers, members and non-members alike. To ensure that all areas of operations and business are represented, Department Heads have been given their respective assignments, to wit:

Finance Units

- Financial Highlights (Annually): Submit key financial performance metrics for the year.

- Annual Report: Provide the annual report for publication on our website and social media platforms.

Administration Department (Handling Over-all Administration and PPSTA Events)

- Organizational Structure: Ensure that the current structure and leadership details are updated.

- Corporate Governance: Provide updates on governance policies and procedures.

- General Manager’s Corner: Share regular messages or announcements from the General Manager.

- President’s Corner: Provide updates or messages from the President’s Office.

- Contacts: Ensure all contact details are accurate and up to date.

- Dormitory Services: Share updates on dormitory accommodations and related services.

- Publications: Submit any publications (newsletters, reports) for dissemination.

- Affiliations: Update and provide information on organizational partnerships and affiliations.

Human Resources Department

- Careers: Post needed job openings, career opportunities, and any relevant HR announcements.

Marketing Department

- Product Updates: Provide information on new and updated products and services.

- Teachers’ Welfare Programs: Share updates on initiatives aimed at improving teachers’ welfare.

- Advocacies: Submit pictures and details on advocacy campaigns the organization supports as well as their marketing progress/schedules/reports/updates

Loans, Claims, and Membership Departments

- Forms: Provide updated and necessary forms for loans, claims, and membership processes.

- Requirements: Ensure all requirements related to loans, claims, and membership are up to date and accessible.

- Loans – Loan Releases

- Claims – Benefit Releases

- Membership – Top Regions/Divisions in terms of recruitment

- 2024 National Representative Assembly (NRA)

As proposed by the Management, the 2024 NRA will be held on December 12-13, 2024. The NRA Gala/Opening Ceremony where the awarding for the search will be held shall be on December 12 while the Business Proper, Election and Closing Ceremony will be held on December 13. We await for the final instructions from the Board and the COMELEC but I assure everyone that the Management is ready for the event.